-

404

Sorry, the page you were looking for doesn’t exist.

Please continue to…

Page Not Found Style 1

Examples

About Me

Hi, I'm Daley. I fetch Greg’s email and bring it to him. Getting your messages gets me a treat. So send as many messages as you want! Welcome to our blog!

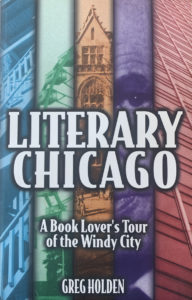

Read More About Greg HereMy Best Seller

My Favorite Book

Latest Posts

-

Every Invisible Creature

April 27, 2022

Every Invisible Creature

April 27, 2022

-

Seven Blessings for Working With Dementia Patients

April 13, 2022

Seven Blessings for Working With Dementia Patients

April 13, 2022

-

The Injured Bird that May Change My Life

April 10, 2022

The Injured Bird that May Change My Life

April 10, 2022